Understanding Labuan Company Registration

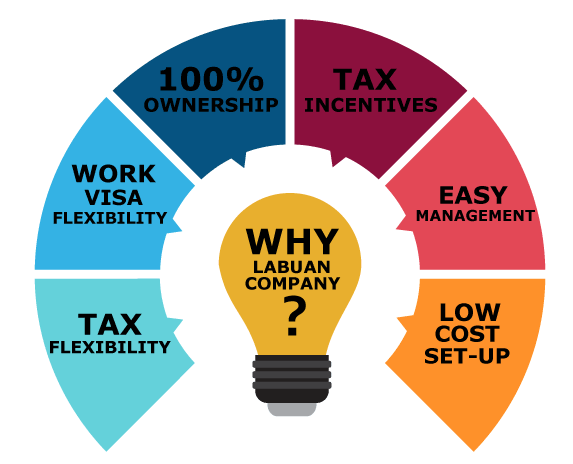

Labuan company registration refers to the procedure of establishing a business entity in Labuan, which is recognized as Malaysia’s offshore financial center and operates under the Labuan Companies Act 1990. Registering a company in Labuan presents various advantages, including favorable tax conditions, reduced reporting obligations, and the opportunity to tap into global markets.

This registration process is particularly beneficial for Malaysian entrepreneurs aiming to connect with international clients while maintaining privacy and optimizing their tax strategies.

Name Availability Check & Reservation: We will perform a name search to confirm that your desired company name is unoccupied.

Tax Benefits: Companies in Labuan can take advantage of a minimal corporate tax rate for trading entities.Complete Foreign Ownership: International investors can fully own their companies without requiring a local partner.Efficient Fund Transfers: Labuan entities are permitted to engage in transactions using foreign currencies.Versatile Business Operations: The framework is ideal for businesses involved in international trade, e-commerce, and professional services.

what makes us different

The values we live by

Wide Range of Business Activities

From trading and holding companies to fintech and investment firms, Labuan, Malaysia offers flexibility that rivals the Cayman Islands and BVI—without the same reputational risks.

Strategic Location in Asia

ocated in the heart of Southeast Asia, Labuan gives your business access to fast-growing Asian markets, including China, ASEAN, and the Middle East.

Ease of Doing Business

Company incorporation in Labuan is fast, cost-effective, and remote-friendly, with minimal bureaucracy compared to Singapore and other hubs.

Attractive Tax Regime

Enjoy a low corporate tax rate of 3% or a fixed annual tax while maintaining substance and transparency. This makes Labuan more sustainable compared to zero-tax jurisdictions often flagged by regulators.

improve your body

The Facts Behind Labuan’s Global Edge

Unlike lesser-known offshore jurisdictions, Labuan, Malaysia is recognized by the OECD and backed by Malaysia’s strong economic framework, ensuring compliance and credibility

main features

Initial one-to-one consultation, Health & Fitness Assasments Bespoke training program planing, Custom Nutrition plan & recipes. Weekly Progress Reviews

- 25+ Years of Regulatory Stability Established and trusted within the Asia-Pacific region

- 3% Corporate Tax Competitive, transparent, and internationally recognized

- 100% Foreign Ownership

Financial Licenses & Immigration Services

Comprehensive solutions for your business and residency needs

Financial Licenses We Can Secure

Labuan Digital Bank

Full-fledged digital banking services with cutting-edge AI-powered financial solutions

Labuan Bank

Full-fledged conventional banking operations with comprehensive financial services

Investment Bank

Credit facilities, consultancy, advisory services, foreign exchange and banking services (excluding deposits)

Digital Exchange

Securities exchange platform for listing and trading digital assets with AI-enhanced security

Money Brokering

Arranging transactions between buyers and sellers in money or foreign exchange markets

Payment System Operator

Payment platform and e-wallet services with smart AI-driven transaction processing

Fund Manager

Management, advisory and administration services for investment funds

Securities Licensee

Investment advice and administrative services for investment purposes

Credit Token

Token issuance services for specific financial and commercial purposes

Factoring

Debt acquisition and management services for businesses

Building Credit

Specialized credit facilities for construction and building projects

Development Finance

Credit facilities dedicated to economic development projects

LITC

Labuan International Commodity Trading Company services

LCMB

Treasury, liquidity and financing management for related companies

Leasing

Aircraft, vessels and high-value equipment/machinery leasing services

Foreign Talent & Immigration Solutions

Labuan Employment Pass

Requirements:

- Director or top management position

- Tertiary education or professional qualification

- Minimum monthly salary of RM10,000

Malaysia My Second Home (MM2H)

Financial Requirements:

- RM1.5 million liquid assets

- RM40,000 monthly foreign income proof

- RM1 million fixed deposit (post-approval)

- Additional RM50,000 per dependent